On 3 January, a wholly-owned subsidiary of Jinko Solar Co., Ltd. ("JinkoSolar"), filed a lawsuit against LONGi Green Energy Technology Co., Ltd. ("LONGi"), requesting the latter to immediately stop infringing the invention patents related to TOPCon technology and to compensate for the economic losses. The lawsuit is scheduled for trial on 13 February.

Photovoltaic companies continue to suffer losses amid overcapacity

Patent wars are likely to be a means of competition in the solar industry.

At present, the solar giants, although presenting a thriving scene, are suffering from dismal earnings.

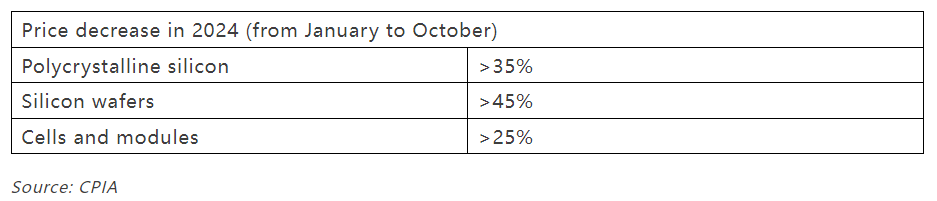

Over the past two years, the photovoltaic industry chain has experienced a high-speed expansion. From the upstream supply of silicon to the downstream production of modules, each link has experienced a significant increase in production capacity. However, this rapid development has also brought about massive overcapacity, which in turn triggered price fluctuations and intensified competition in the market.

The bleak export environment makes things worse. Although China's photovoltaic products are highly competitive, Chinese solar companies found it hard to gain profits from the global market due to the global economic situation, trade policies in large markets and other factors.

Speaking at China Photovoltaic Industry Association's 2024 Review meeting, CPIA's Honorary Chairman Wang Bohua said that China's PV export volume totaled around $28.14 billion, a decline of 34.5% year on year and that it was despite the fact that the export volume of cells and modules having soared up 41.8%, and 15.9% respectively.

The industry has fallen into disordered competition. According to the statistics of CPIA, in 2024, 39 out of 121 listed photovoltaic companies reported net profit loss. Industry leaders suffered the worst loss.

Facing fierce market competition, JinkoSolar is not the only PV company that has taken up the patent weapon to fight against its competitors. In 2024, Trina Solar filed lawsuits against Runergy and Canadian Solar for patent infringement in the U.S.; JA Solar filed lawsuits against Astronergy at the German offices of the Unified Patent Court (UPC).

Technology iteration adds uncertainties for the competition

While the external problems are difficult to solve, the internal problems are also head-scratching.

At present, PERC (Passivated Emitter Rear Cell) is still the mainstream technology of photovoltaic cells, with a market share of over 90%. But as cell efficiency gets harder and harder to increase with PERC technology, a new round of technology iteration has begun. The N-Type technology, which features higher efficiency, lower attenuation rate and better low-light performance, has been identified as the next generation of PV cell technology. In terms of specific technology routes, TOPCon(Tunnel Oxide Passivated Contact), HJT(Heterojunction with Intrinsic Thin-film), and IBC(Interdigitated Back Contact) are the three most sought-after battery technologies.

Solar companies are once again facing tough choices. Each innovation requires a huge amount of capital investment, it is difficult for even the industry leaders to achieve an all-round layout, not to mention that Chinese solar giants are all losing money at present stage and therefore only have a limited budget.

JinkoSolar is optimistic about the TOPCon technology and is fully engaged in the R&D of TOPCon batteries. It currently has a proprietary portfolio that includes 462 industry-leading patents related to N-type TOPCon technology. On 6 January, the company announced that it has achieved a significant breakthrough in the development of its N-type TOPCon-based perovskite tandem solar cell, which achieved an impressive conversion efficiency of 33.84%, setting a world record for efficiency and power output for PV products.

However, JinkoSolar has only a little investment in the BC route.

LONGi's choice of technology route is significantly different from JinkoSolar. At the Investor Presentation for 2023, LONGi announced that it would take BC cells as the company's core technology route, and predicted that BC cells would become the absolute mainstream of crystalline silicon cells in 5-6 years. According to the data in LONGi’s Semiannual Report 2024, as at the end of the reporting period, the Company had obtained 3,166 authorized patents of various types and nearly 200 BC technology patents.

Therefore, in addition to defending its IP, the purpose of JinkoSolar's lawsuit against LONGi may also be to put pressure on the latter to ultimately move towards a settlement, such as cross-licensing between the two parties, in order to achieve technological complementarities, and to prevent itself from losing its leading position in the new round of technological iteration.

The example is Maxeon Solar Technologies, Ltd. (Maxeon) vs. Tongwei Solar (Hefei) Co., Ltd., which settled in November 2024. According to Maxeon’s announcement, the companies have entered into a Settlement and Cross-Licensing Agreement, effective as of November 30, 2024, regarding shingled solar cell and module technology.

Comment