India’s Controller General of Patents, Designs and Trademarks (CGPDT) released its annual report for the 2015-2016 fiscal year last week, and the results showed a 10% jump in applications, reversing two straight years of slight decline. The list of top applicants for the first time included a Chinese company, as Huawei at least tripled its filings in India – which continues to be a market of great risk and great opportunity for Chinese smartphone makers.

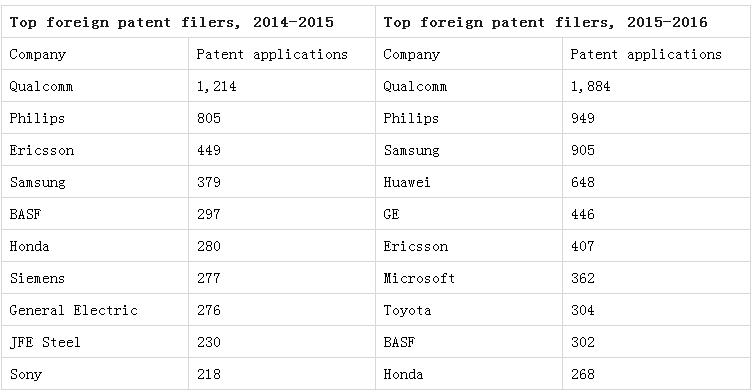

The headline growth in patents filed came as multinationals ramped up patenting in India after a previous retreat (foreign filings fell 4% and 5% in the previous two years). Little surprise that telecoms companies led the way as licensors continue to file new infringement lawsuits in the mobile phone space, many targeting Indian and Chinese manufacturers. Qualcomm retained its position as the top overall patent filer in the country, but it put a lot more space between itself and the number two company, Philips, increasing its applications by 55%. Microsoft and Toyota also increased their activity enough to break into the top 10.

The real surprise was Huawei, which shot to the fourth overall position, filing 648 patents. It doesn’t appear that Huawei or any other Chinese company has previously figured in the list of top filers published each year by the Patent Office, but there is very good reason for that to change. Companies like Xiaomi, Oppo and Vivo have taken a lot of market share in India, largely at the expense of homegrown brands like Micromax and Intex. But all three have found themselves the target of litigation in India, which usually means having to pay a court-ordered interim royalty to avoid an injunction. For its part, Huawei doesn’t sell many phones in India, but it has clearly concluded that it can benefit strategically from a stronger portfolio there. Its absence from the list at left below suggests that its application volume at least tripled.

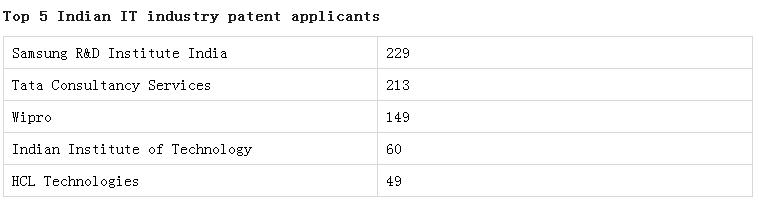

Indian entities, which continue to account for about a quarter of all applications, also increased their rate of filing. Tata Consultancy Services remained the country’s top domestic applicant in the IT space, with 213 applications last year, a 45% increase. Wipro also grew its output. But the other of India’s three largest IT services providers, Infosys, was once again nowhere to be found. As this blog reported in November, the company said it only filed nine total patent applications for the 2015-2016 fiscal year.

Overall, the Council of Scientific and Industrial Research (CSIR) was once again India’s top domestic patent applicant. But the future of that organisation’s IP function is very much in doubt after its own director general characterised its patenting activity as a waste of taxpayer money and the group’s commercialisation arm was forced to shut down for lack of funding. Next year’s figures will show us what the fallout is at CSIR are potentially at other Indian research institutions.

Patent owners say bringing down pendency times – which average five to eight years – is a big obstacle to making patents more enforceable in India. The patent office examined less than 17,000 applications in 2015-2016, compared to the 47,000 it received. But Controller General O P Gupta says that a big injection of manpower will see the backlog of patent applications cleared within the next two years. In an interview with Business Today, he stated that 286 examiners had completed training and started work in the last year, while another 149 are in training. While the office examined an average of 1,400 patents per month during 2015-2016, Gupta says that in January 2017 it examined 3,800. The hope is that by the middle of this year, the office will be examining 6,000 patents per month. Good news for enforceability, but it also means that more than half of the country's examiner corps is going to be very inexperienced, while still being expected to clear 12 applications per month. Applicants will be keeping a close eye on quality.

Comment